Up Next

Formula 1 has voted through a radical rules package including a big percentage cut from the impending budget cap and further efforts to reduce costs, in the name of financial sustainability.

F1’s push for financial sustainability does not begin or end with the budget cap.

It is only one part of a jigsaw that also includes reducing spending on car and engine development, and the unknown variable will be the adoption of an aerodynamic development handicap system, explained here and designed to bring the field closer.

Financial matters have prolonged discussions and are at the heart of the package voted through on Friday and expected to be ratified by the World Motor Sport Council next week.

Ferrari and Red Bull had been vocal opponents to what they see as opportunistic efforts during the coronavirus pandemic to radically alter the make-up of grand prix racing.

They bristled at being told how much money they can spend, and how they can spend it.

But with rulemakers set on using the COVID-19 crisis to dramatically slash costs in F1 and improve the championship’s competitive spread, the teams with grievances have ultimately ceded ground and supported the bigger picture.

The cost cap is set to be $145million for 2021, $140m for 2022 and $135m for 2023-25. There are exemptions from the cap, including marketing costs, engine manufacture, driver salaries and the salaries of the top three employees.

Within that cost cap, there is still room for teams to buy/sell components. This is commonplace in F1, with Mercedes, Ferrari and Red Bull all enjoying customer relationships to different degrees with Racing Point, Haas and AlphaTauri – in addition to their other engine customers.

Ferrari and Red Bull argued that they should be afforded a bigger budget cap to recognise the extra research and development costs they undertake to create components, which others can then purchase at a much lower price.

Instead of a two-tier budget cap, it appears the resolution has been to assign such parts a notional value that is higher than the purchase price would normally be. This will then come out of the buying team’s budget cap. The team that creates that component will have to factor development costs into its own spending.

The disliked notion of standardisation, which was opposed on the grounds of reliability risks and the potential for extra spending during development to ensure parts are of sufficient quality, has been tackled by the adoption of an open-source system.

This should create pseudo-standardisation, requiring teams to publish their designs for certain parts online. It’s a form of standardisation in a way that’s far more palatable for the teams, as the best designs can be adopted without the need for every team to invest in R&D.

This will require patience to have a big impact though as initially teams will need develop their own components. They will not have time to wait for someone else’s plans to be made public.

But it should reduce costs across the board: once the open-source pool is big enough the small teams can dip in and save themselves development spending, while for the bigger teams committing money to these areas will be futile.

“It ceases to be an area where any of us would particularly want to spend development money because a good design is out there,” Mercedes technical director James Allison noted last year.

Reducing the actual costs rather than just placing a cap on expenditure is key – as is income distribution, although this will only be addressed through the next Concorde Agreement, which is on the backburner at the moment.

But the budget cap has been the headline attraction. So what does it actually mean when applied to each of the teams?

Obviously, there are two sides to the equation of the teams’ bottom line – income and expenditure. The cost cap solely addresses the latter. We need to look at the combination of the two to get an accurate picture of the financial position of each team – and how that picture will be affected by the Liberty cost cap proposals that have just been voted through by the teams after many months of negotiation.

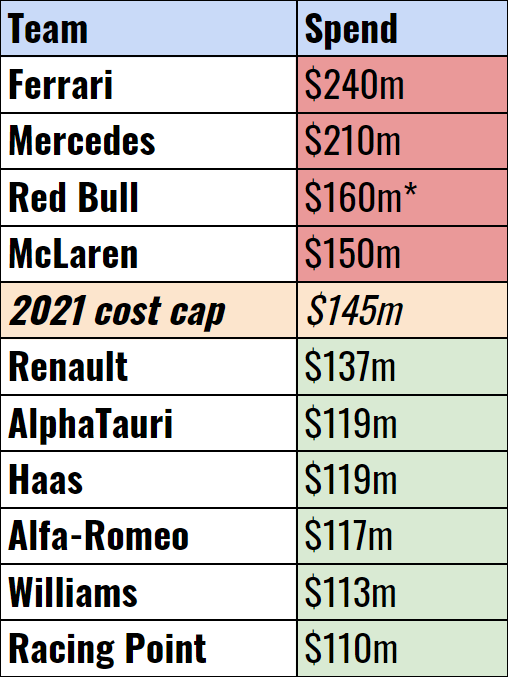

Below is our realistic but approximate estimate of each team’s 2019 expenditure with exemptions of marketing costs, engine manufacture, driver salaries and the salaries of the top three employees in place, based on a combination of educated guesswork and some hard info.

Estimated 2019 expenditure (with exemptions)

As can be seen, six of the 10 teams are already below next year’s $145m cap and five of them are below even the 2023-25 cap. Getting down to $145m from the $200m+ of Ferrari and Mercedes looks a potentially painful process.

Red Bull, because of free engines from Honda, comes out of the exemption-adjusted comparison well, i.e. with less savage savings needed – although its spend is likely closer to Ferrari and Mercedes but it’s difficult to establish given the split between Red Bull Racing and the technology arm of the company. McLaren would need to make small savings to meet the cap. The rest shouldn’t be directly affected by it.

Obviously, the smaller teams should benefit from any restriction which impacts upon the top teams but not them. But that’s only addressing the expenditure side of the equation.

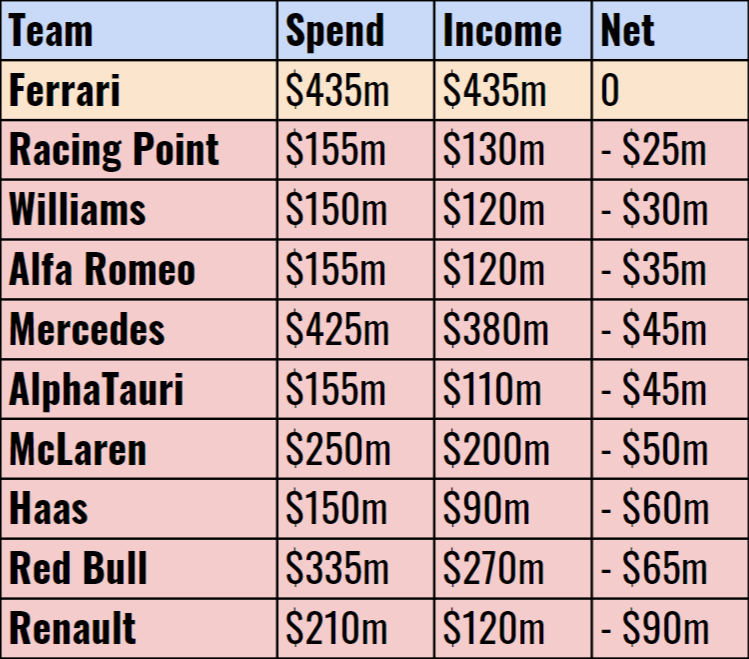

The picture changes when the teams’ income (from FOM and sponsors). Looking at the actual expenditure without the exemptions and comparing it with income reveals this picture.

Estimated 2019 finances without exemptions

The net figure would be the sum that the team’s shareholders would be providing to make the books balanced. As can be seen, Ferrari is in by far the best position here, but Mercedes is also in a position to turn a profit without Daimler intervention.

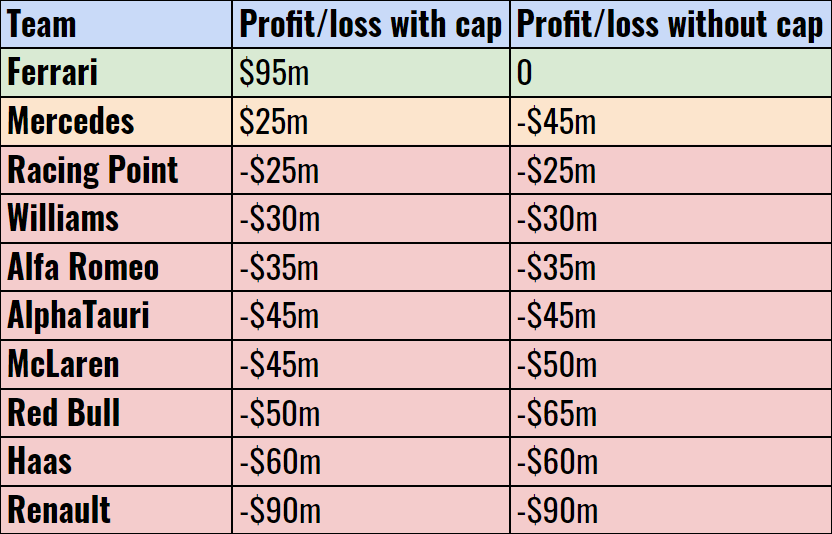

If we could assume the same level of income of each team in 2021 (which will almost certainly not be the case) with budget caps applied, the savings would theoretically put Ferrari’s operating sum $95m in profit. Mercedes’ deficit would be reduced from $45m to a $25m profit. Red Bull’s would be reduced from $65m to $50m (subject to the realities of the split in funding between RBR and the Tech division). McLaren’s deficit would be reduced to $45m.

Impact of budget cap on 2019 profit/loss

This illustrates the picture that the commercial agreement between the teams, after the current contract ends at the end of this year, will have to address.

But looking at the difference in expenditure with exemptions in place also serves to highlight the impact that engine development has, as this will be a significant percentage of that.

We cannot define the exact costs undertaken by Mercedes, Ferrari, Honda and Renault in this regard but we know that it is extreme and there is a common desire to bring that spending down.

In fact, despite finally winning in F1 again, Honda had to convince its board last year that the project was worth continuing with. Cost saving played a big part in those discussions.

To that end, another agreement is to limit engine development this year and next, with the BBC claiming that limiting the number of upgrades through the year and restricting dyno hours are the two main factors.

Honda in particular has been more aggressive than its rivals with engine upgrades as it has sought o catch up from its early disadvantage when it joined in 2015.

Presently, manufacturers target two upgrades during the season.

A budget cap is coming to F1. Unlike the last attempt to curb spending, this is going to happen – and at a more aggressive level than initially agreed.

But it is supported by a raft of other measures that have been reinforced by Friday’s vote.

Which is why rulemakers are encouraged that this package will be strong enough to stand the test of the current times.